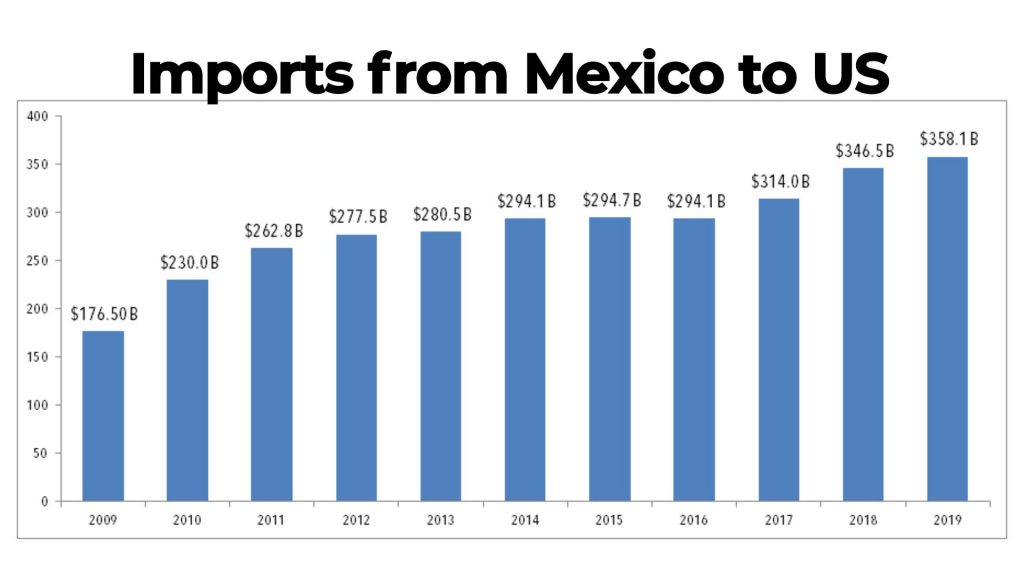

Mexico has become the number one trading partner with the United States.

While traditionally China has held that place, recent tariffs, reduced

transportation costs, increased oversight then more recently the coronavirus

have pushed Mexico to become the top trading partner with the US. The total dollar

amount of this trade was $614.5 billlion in 2019 according to US census data.

The automotive and electronics industry have helped to solidify Mexico’s rise

over the last couple years.

Mexico has become an increasingly important trading partner following the

1994 NAFTA agreement, which brought greater flexibility to North American trading partners in general, making it easier for firms to buy goods in one country then cross border ship from Mexico to the US or cross border ship from Canada to the USA as examples.

There is an interesting reciprocity

to the trade balance between the USA and Mexico, unlike the more import

driven trade balance between China and the USA. Many more basic parts, sub

assemblies and finished products are built in Mexico, then many much more

complex technology or high tech machinery is built in the USA then shipped to

Mexico. Agriculture represents an important component of trade as well between

the USA and Mexico.

Common items made in Mexico and shipped to the US include autoparts,

aerospace components, automobiles and automotive manufacturing components,

agricultural goods and produce, clothing and packaged goods.

A lesser known benefit to locating production in Mexico versus Asia is it’s

closer proximity to the USA. This make managing factories including setup and

quality assurance, and supply chain planning much easier. The majority of goods

shipped from China travel via ocean ship which roughly takes a month to get to

the US. Air freight is another option but much more costly for importers.

Mexico opens up the option to over the road truck carriers and railroad

transportation services. Particularly for buck commodities and goods moving in

large quantities rail freight is the most efficient and cost effective method

to move cross border Mexico freight to US locations. The majority of consumer

goods are moved via truck while a smaller percentage of cross border retail

imports are moved via intermodal rail container services. Instead of taking a

month, cross border supply chains can move freight within a few days. This

makes it much easier for companies to maintain just in time inventory levels

and cuts down on lead times.

The ability to quickly travel to Mexico in a couple of hours also provides a

much easier way to manage the factory and build relationships with suppliers.

Supply chains operating in Asia, depending on their size, typically rarely meet

with their Asian suppliers or are large enough to have a remote team working

there. While with Mexico, teams can quickly be on the ground if a problem

arises in a factory.

While a more recent development, the current administration tariffs on China

in particular have created further incentives for major US companies to

consider alternatives for their manufacturing. Mexico is one such country that

is experiencing an increase in trade due to this, others include India and

Vietnam. Many large companies that have a diverse supply chain prefer to have

several factories located in different countries as a way to minimize over concentration

risks.

There has also been a shift in the type of American purchasing and investment in China, with a recent shift towards higher end manufacturing and electronics. Historically US firms utilized China’s manufacturing capacity for more simplistic and basic items.

COVID19 introduces an entirely new set of challenges for any supply chain.

With factory closures driving down freight volumes and thus ocean and air

carriers reducing sailings and flights, supply chains are left in a precarious

situation as they scramble to maintain inventory for products that are still experiencing

demand. The full ramifications from the coronavirus will likely not be truly

understood for another year or so, but early predictions point to supply chains

putting increased emphasis on supply chain diversification and questioning just

how low they should maintain their inventory levels.

Recommended for further reading:

https://wits.worldbank.org/CountryProfile/en/MEX

https://www.census.gov/foreign-trade/balance/c2010.html

https://www.foxbusiness.com/markets/china-trade-partner-us-war

Zmodal provides comprehensive logistics services with an emphasis on nationwide and cross country full truckload and intermodal coverage. Our propreitary dashboard makes searching routes, booking loads, shipment tracking, payments and shipment documents as easy as booking a flight. Try us out today!