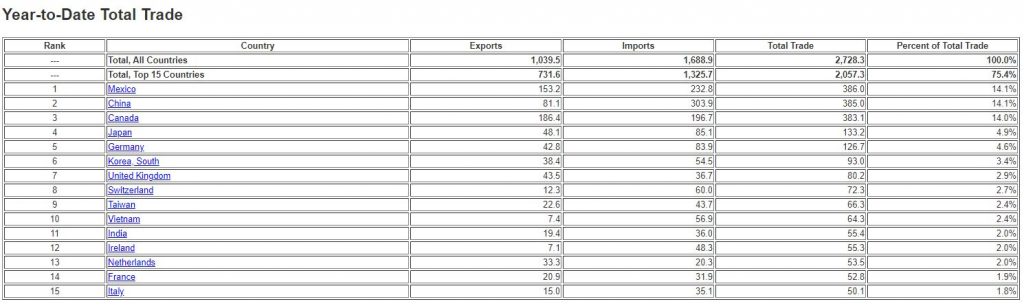

For decades China has been the factory of the world, providing US and international firms the ability to produce products much cheaper than domestic production would allow. In 2019 total trade between the US and China totaled an immense $634.8 Billion dollars, while recent sanctions and the ongoing coronavirus pandemic have slightly reduced overall trade between the US and China, it is still, depending on the month, the largest overall trading partner with the United States.

As of US census data from September 2020, China and Mexico are neck in neck for the top trading partner spot, with less than a 1 billion dollar difference between them.

2020 finds numerous companies planning to diversify production from China, in an effort to reduce reliance on a single country for a majority of production, thus creating a more resilient supply chain, and in addition, reduce tariff impacts, reduce transportation costs and nearshore under the new USMCA agreement.

China will always remain a top, if not the top trading partner of the US, but expect to see more and more firms look to USMCA members for nearshoring opportunities and expand production to southeast asia as well.

So why are companies deciding to look at countries outside of China for production capacity?

First let’s take a quick look at the rise of china as a major manufacturing power

The rise of China

Prior to the 1980s, very few international goods were actually made in China, however, Chinese President Xiaoping Deng felt strongly China needed to redefine its economic system and institute what was arguably a market-based system and also created industrial zones. The lower costs of Chinese labor helped to push China to the forefront of manufacturing over the next few decades. Over this time, China’s infrastructure has evolved with the manufacturing demand, and now China has the ecosystem and assets in place to produce nearly anything quite efficiently. The city of Shenzhen in particular has become a major hub of electronics manufacturing. While many will critique China’s currency valuations through the years, it has to be said that a lower valued currency does promote exports as it makes purchasing goods cheaper relative to another nation.

Some might incorrectly think that most goods manufactured in China are more simple fabric or plastic-based goods, but this is simply not true. China has a highly advanced manufacturing industry that can create highly precise and complicated automotive, aerospace, medical and electronics components. For examples of this look at Apple’s huge Chinese manufacturing investment, Tesla is another that is in the process of building a factory in China.

So Why are Companies Shifting Manufacturing from China

Over the last few years, many firms have started to realize that China isn’t quite as cheap as it once was from a labor and cost perspective, that tied with in an at times turbulent political relationship, ongoing tariffs and trade disputes then finally the COVID19 pandemic has made firms question their heavy reliance on China as a near sole source of many parts and goods.

COVID19 in particular was a stress test for many supply chains, with China’s factories shutting down well before the rest of the world was hit with the brunt of the pandemic. Companies ranging from small businesses to global leaders like Mazda and Apple have been hit hard by covid related factory shutdowns that have caused part and product shortages.

This has pushed these firms to think long and hard about relying on a sole country as a source of production. Mazda for example immediately turned to Mexico to build certain sub-assemblies needed to keep a Japanese factory running.

Tariffs have also been an ongoing source of frustration for many US firms buying Chinese goods and materials. While the effectiveness of tariffs is questionable, they have none the less been implemented on many types of imports. Tariffs currently range between 7.5%-25%. As of late 2020, these tariffs have totaled nearly $80 Billion, which is a substantial sum on a vital trade artery.

What to expect over the next decade?

It’s impossible to predict exactly what will happen over the next 3-10 years, with the recent Presidential election potentially affecting the levels of tariffs as we enter 2021. However, even if we assume tariffs will decrease, supply chain resiliency and diversity has become a major focus primarily due to covid19. It has put companies in situations in which they vow they will do everything they can possibly do to avoid in the future. As US firms start to plan major capital budgets going forward, it is very likely they will prefer to diversify their production base and not solely rely on Chinese factories. There have been reports that firms such as Microsoft, Amazon, HP, Dell and Sony are looking for ways to diversify production outside of China.

Countries such as Mexico, India, Vietnam, Bangladesh, and Taiwan will experience a rise in industrial investment from foreign firms and will do everything they can to promote it. Mexico in particular for US firms presents an interesting mix of benefits including much easier oversight due to it’s close proximity to the US, reduced transportation costs since trains and trucks can be used in place of ships and planes, quicker lead time, favorable trade agreements, and a favorable political situation.

Many US manufacturing and logistics experts are predicting a large rise in the amount of cross border freight and US firm’s manufacturing presence in Mexico. Several North American railroads are even starting to invest in additional cross border Mexico freight capacity to capture future volume increases.

Conclusion

China will remain a MAJOR if not the top US trading partner for decades to come, however in an attempt to build more resilient supply chains that are not so heavily reliant on one country, firms when start to diversify to several other potential countries for some of their manufacturing capacity.

Any changes introduced will create new opportunities and challenges for trading partners, logistics companies and industrial development firms.

In addition, while the US political landscape could change the rate at which this change occurs, it likely won’t have too large of an impact on the overall outcome as many firms are strongly committed to create more resilient supply chains irrespective of any tariffs.

Mexico, India, Vietnam, Taiwan and Bangladesh will see rises in foreign manufacturing investment and overall exports rise.

Recommended for further reading:

https://en.wikipedia.org/wiki/United_States%E2%80%93Mexico%E2%80%93Canada_Agreement

https://www.census.gov/foreign-trade/statistics/highlights/top/top2009yr.html

Zmodal provides comprehensive supply chain solutions that are data based and focused on optimizing your supply chain logistics plan for better reliability and efficiency. We focus on a multimodal approach to building resiliency that is backed by a first class team that provides 24/7 support and the technology to keep your supply chain connected and visible. Our technology provides shippers easy access to convert over the road freight to intermodal. If you want to talk or want a completely free initial consultation, give us a shout!