Tesla delivered nearly 500,000 cars in 2020 and has a near 700 Billion dollar market cap.

The domestic trucking market in the US alone is an 800 billion dollar-a-year industry that employs 947,000 commercial drivers. Naturally many trucking firms, including both incumbents and new players, are trying to establish themselves as the Tesla of the trucking industry.

With federal emissions regulations steadily increasing, and the long-term upward fuel price trend, coupled with a potential future carbon tax, truck manufacturers just like passenger vehicle firms are working hard to develop electric commercial vehicles.

Challenges

The benchmark for any electric vehicle, whether fair or not, is a Tesla. A Tesla S has a range of over 350 miles, develops 670 hp, and weighs around 4941lbs.

One of the core problems with building electric semi-trucks, is the power density is a major challenge. Many semi-trucks weigh right at 80,000 lbs, with 45,000 of cargo, often traveling 600 miles or so daily.

The sheer amount of battery capacity needed to deliver that kind of range and power is the largest challenge to long-haul electric semi-trucks. The larger the battery, the more it weighs, which then reduced the amount of cargo the truck can carry.

While teslas have the luxury of a supercharger network with locations popping up all over the US, semi-trucks have no such luxury. Additionally, the larger the battery, the longer the charge time.

No doubt in the next decade commercial electric truck manufactures will hopefully standardize the charging port and truck charging terminals will start to pop up at truck stops across the country.

Self Driving Trucks

While many will argue that Tesla’s widely hyped self-driving system isn’t true “self-driving”, its highly advanced cruise control system is still a remarkable upgrade for the vast majority of vehicles on the road today.

Trucking firms are working to develop similar technology for commercial electric trucks that will allow the driver to takes his hands off the wheel at least for small periods of time while the truck guides itself safely down the road. This level of automated driving- effectively an advanced “supercruise” on highways is really already here, just not federally approved outside of test situations for trucks. But true self-driving trucks, that can handle complex situations or even origin/destination maneuvering are still a ways off.

The holy grail that many expect to see is truck platooning, which is where multiple trucks follow a leader very very closely ( FOOT?). There are many variations of this, but some include a driver only in the first vehicle. But this type of truck automation would unlock massive amounts of capacity within the industry and deliver a much stronger ROI on truck purchases. As trucks could operate many more hours per day depending on the type of automation system deployed. Imagine a single driver controlling 10 trucks in a platoon, and the driver having the ability to sleep while the truck is on the highway, That would be game-changing for US transportation firms and supply chains. Of course, railroads could see this as a threat as their long-haul cost savings and efficiencies could be challenged in certain circumstances with this type of technology.

Electric Mail Trucks

Mail trucks and final mile delivery vehicles make a lot more sense as early adopters of electric drive trains- they operate in a smaller geographic area, short-haul service, and generally don’t carry anywhere near the cargo load of larger semi-trucks.

Incredibly the United States Postal Service placed a 482 million dollar order for Electric mail trucks in 2020. This is a near-perfect match for first-gen electric trucks.

What does it mean for supply chains?

That’s anyone’s guess. Thinking about long-term trends, total freight volume in the US will continue to grow quite a bit, emissions regulations and fuel prices will rise – these will put upward pressure on transportation prices. In effect, platooning and electric vehicles could partially cancel out the mentioned upward pressures, which would mean little practical differences for supply chains other than companies that own trucking assets themselves.

The speed of electric truck adoption will largely depend on the reliability of the vehicles, their capabilities then outside the market and regulatory pressures. Expect to see many of the larger trucking firms rolling out electric vehicle trial programs over the next several years.

Supply chains and supply chain firms are always searching for increased efficiency and cost reduction, just as automation is taking over warehouse and distribution centers, eventually, electric trucks will be playing an integral role in global supply chains.

Electric Truck Manufacturers

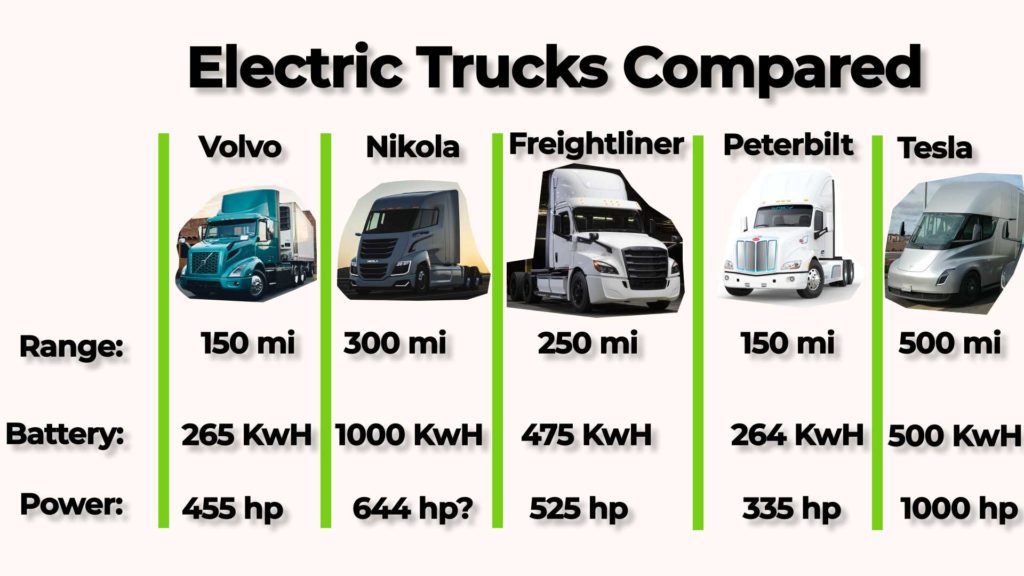

A wide range of companies have started or are planning to build commercial electric trucks. Industry leaders such as Volvo, Peterbilt, and Freightliner have already put hefty amounts of r&d dollars into electric truck propulsion, then new players such as Rivian, Nikola, and of course Tesla are also working on vehicles

Over time, all the major truck manufacturers, just like automakers, will be forced to develop electric trucks if they want to stay relevant within the industry.

Just like with the trials that have already taken place, electric truck manufactures will focus on low volume trial programs, and short-haul offerings first, letting the technology mature before long haul trucks are commercially made available.

Truck stops will also play a major role in the adoption of the technology, as charging stations will be needed for the widespread use of long-haul electric trucks. No doubt new players will also enter the “electric truck stop” market as well.

While these vehicles are still in prototype phases, their specs still represent unique differences between the various competitors. No doubt that as they move into full production-spec, certain detail regarding power, horsepower and range will be tweaked.

Electric Drayage Trucks

In 2019 the Port of New York/ New Jersey made the first delivery using a an electric drayage truck. Port authorities are continually increasing their emissions standards for trucks that enter their facilities in an effort to reduce greenhouse gas emissions and improve air quality. Additionally, many port facilities are often near large metropolitan areas such as Los Angles or New York, which are working hard to maintain clean air for residents.

Drayage is one of the most approachable niches within the trucking industry as many deliveries are under 100 miles, some even less, and trucks are often used in captive service moving freight in and out of one port facility. This is the perfect opportunity for early commercial applications of electric trucks as it doesn’t require trucks to have extremely long ranges or necessitate fast charging infrastructure to be built across the country.

For those not familiar with drayage, it is a niche within the greater trucking industry for short-haul trucking, often into and out of port facilities to distribution centers, manufacturing facilities, or warehouses. Drayage is also used to provide the first and last mile for intermodal freight, which is using a combination of trucking and rail, which provides efficient long-haul transportation options. In port facilities, drayage trucks are often used to move containers from a pier or dock facility where the container was unloaded from a ship to a rail yard where the container is loaded onto a train, then once the train reaches its destination, another drayage truck is used to move the container from the railway intermodal transload facility to the final destination.

Expect to see more and more trail runs and testing of electric trucks in drayage service.

Planes, Trains and Ships

Many companies are experimenting with electric powertrains for other forms of commercial freight transportation including trains, ships, and even planes. Elon Musk himself believes that electric planes are possible, but these would likely first be passenger planes that don’t require the ability to carry large amounts of cargo. The limitation, just like with any other electric vehicle is the energy density of the battery pack.

Trains also have an issue with energy density, as they operate under extreme loads on thousand-mile distances. It will likely be a long time before battery-powered trains haul mainline long haul trains. However, for industrial switching operations, battery locomotives could be a great option, and will likely be the first commercial deployment of battery-electric locomotives.

In certain parts of the world, railways are already electric by means of overhead power systems, that deliver electricity to electric locomotives unlike the diesel-powered freight locomotives in the USA. If electric power for freight rail becomes a necessity or is pushed by fuel price rises or regulations, there will be very tough decisions made on whether to build battery locomotives or build electric catenary system that would allow for the operation of more traditional electric locomotives. In many the catenary approach might make more sense, as large-scale commercial powerplants – whether solar, hydroelectric or nuclear- are more efficient, the massive cost to build electric catenary systems across the North American rail system would be nearly unbearable for the nation’s railroads.

A major breakthrough in battery technology could unlock other forms of electric vehicles.

The future

Electric vehicles are the future, while some might miss the sight and sound of a naturally aspirated v12 in a sports car or a steam locomotive from years past, progress is inevitable and the long-term effect will be more efficient and eco-friendly transportation of freight globally.