Like any industry, the supply chain logistics industry has seen consolidation over the years. With so many niches, such as trucking, ocean shipping, railroads, and others, each could be the topic of a significant article.

Historical Rail Consolidation

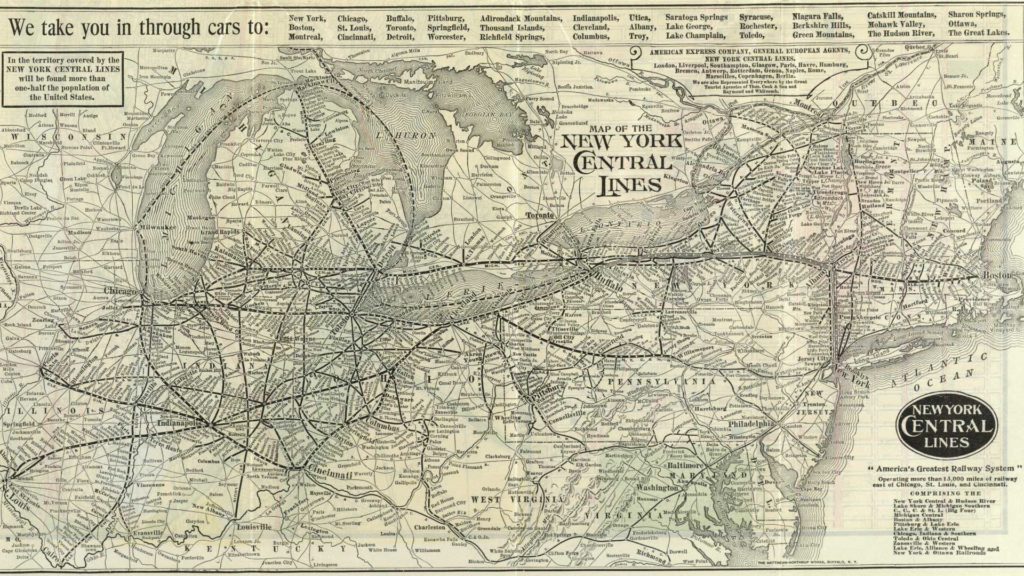

Looking back through the years, mergers and acquisitions have driven the growth and emergence of massive companies with significant reach.

The US rail network is a powerful example of this. In the early 1940s, there were well over 100 class 1 railroads – which are defined by the STB and the then ICC as a “major” railroad by revenue standards and strategic reach.

Over the years, these systems have merged, or been outright bought by others to be ultimately consolidated into just 5 major class 1 railroads in the US.

These acquisitions were made for a number of reasons, but ultimately larger companies brought more efficiency and strategic reach, allowing for 2 rail carriers to move freight from the West to the East coast instead of maybe 4-5 back in the 1940s depending on the origin and destination.

With consolidation comes an inherent decrease in the number of shipping options shippers have and thus a reduction in competition, which can potentially set the stage for price gouging for manipulation.

Consolidation has also been the recent subject of debate regarding the competitiveness of ocean freight since just like with railroads, the number of ocean carriers has substantially dropped over the years, with 5-6 major global players now representing a significant portion of capacity.

It seems that for the next several years there will be increased scrutiny of US rail mergers and line purchases and that transactions will likely focus on smaller opportunities than massive mega-mergers. Examples of this would include CSX buying PanAm railways and CN buying a CSX rail line in New York state, both of which have yet to be fully completed due to the regulatory process.

Ocean shipping Alliances

Amazingly, the top 3 largest ocean shipping alliances now hold 80% of global maritime shipping capacity.

A few recent major mergers include CMA-CGM’s NOL acquisition, Cosco/China shipping and OOCL mergers, Maersk buying Hamburg Sud, and the creation of ONE shipping line.

Beyond more traditional mergers, alliances, which essentially are an agreement between ocean carriers to pool capacity, share vessels, port facilities, and more, have become a new trend. By aligning interests and assets, even wider economics of scale are realizer which allows for more competitive pricing.

These 3 major alliances have a significant impact on global shipping pricing, capacity, and service, which has been the subject of debate and investigations, over allegations of pricing collusion.

Typically though, the addition of alliances has made shipping to multiple locations or on different routes easier for shippers, as it reduces the number of ocean shipping vendors that must be used.

Trucking Mergers and Acquisitions

The trucking industry has also seen a huge number of acquisitions and mergers over the years. With numerous carriers buying other carriers for a variety of reasons, just like with ocean or rail acquisitions.

The asset-based trucking industry is much more fragmented though with thousands of carriers, many being owner-operators that have a single truck.

Because of this widespread fragmentation, it’d be nearly impossible to point to pricing collusion or lack of competition like in the rail or ocean shipping industries.

Even amongst non-asset-based logistics firms, mergers and acquisitions happen. The consolidation of volume lets logistics firms have better access to rates, data, and capacity on a wider number of shipping lanes.

Acquisitions can also be made for tech-based reasons, or to allow the acquiring company to offer a new type of service. In this case, it could be a domestic 3pl buying a freight forwarding company, or a large encumbent buying a tech startup.

For warehouse and fulfillment consolidation is a key strategy to expanding reach since at times there are significant barriers to build new warehouses, which result in new construction taking years.

Airline Industry Consolidation

Over the years the airline business has proven tough with even major players like American Airlines declaring bankruptcy. Classic airlines like Eastern, TWA have fallen victim to a challenging industry with only three major US airlines in current operation – Delta, United and American.

A few major consolidations include Alaska’s purchased of Virgin America, the American and US Airways merger, Continental’s merger with United, Delta, and Northwest, and American purchasing TWA.

Covid-19 crippled the airline industry with little to no travelers and many airlines turning to cargo flights to generate much-needed revenue.

No doubt in the future there will be more large airline mergers and acquisitions, these could be from larger carriers purchasing smaller ones or from a carrier with financial issues being bought by another, or just a strategic play to create scale.

What does this mean for shippers?

In general, the greater supply chain industry is widely fragmented, and likely always will be. Certain components of it may be measureably consolidated, but overall it will always be too large, too many niches, and too expensive for any one firm to start to dominate on a global level.

Expect to see governments become more strict about competitive pricing and fair competition as well. For example, it would be very unlikely for the US’s rail governing body, the STB, to approve any more large mergers with significant concessions such as forced line sales, etc. For shippers, this is a good thing as more competition generally means lower rates and better service.

The political leaders in power at any particular time also have a bearing on the type of regulatory environment carriers face when wanting to merge. External pressures like the continuing covid-19 pandemic have also created unique challenges for the greater logistics industry.

As we always recommend, shippers should seek to build diversity amongst the logistics and supply chain partners they work with. Building relationships with a number of firms gives shippers the ability to more readily find capacity in tough markets like today.

Over time, this will lead to a more reliable and resilient supply chain, as a problem with one partner won’t result in a total meltdown of service.

Zmodal is a top intermodal shipping company providing door-to-door intermodal, and full truckload services nationwide throughout our digital supply chain dashboard which provides easy route searching, booking, document management, and analytics. CONTACT US if you want to lower your supply chain costs or want access to North American intermodal capacity.