Black Friday and the lead-up to it have become one of the largest shopping and retail promotion periods of the year for nearly every brand imaginable. Projections pin total black Friday shoppers in 2021 at over 185 million people, both in-store and online, with e-commerce sales numbers exploding since the pandemic.

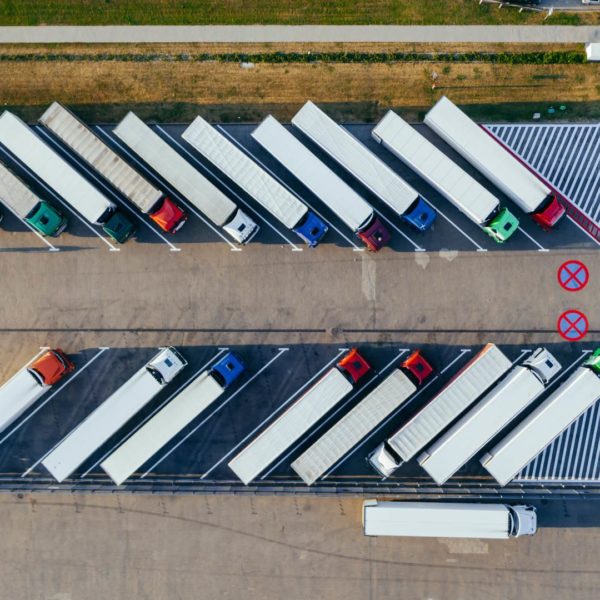

Supply chain disruptions and problems have resulted in a lack of inventory and price increases for many brands. Recent reports put consumer price increases higher than any time in recent history, with an underlying cause being a massive constriction of supply throughout global supply chains. Time will tell if this inflation becomes permanent or if it is a temporary symptom of strained global goods supply.

While Black Friday offers and promotions are being advertised by nearly every retailer, the shortage of inventory for a massive number of items means that prices won’t be as low or competitive as they have been in the past. The number of items that will be offered at steep discounts is considerably less than before. In addition, the amount of inventory for many items will be less, resulting in many products selling out quicker than they traditionally would.

E-commerce will reign supreme over in-store purchases as consumers have shifted their buying preferences away from in-store black Friday sales to ordering black Friday offers online over the course of potentially several weeks of deals.

Cost Increases

Supply chain and logistics costs have risen significantly for a myriad of reasons

The unfortunate reality is that supply chain problems will take a while to work out. The sheer scale of the industry and the number of trucks, ships, and containers involved will likely take more than a year to balance back to pre covid levels of efficiency and cost.

Recent reports from the Port of Long Beach suggest that the number of waiting vessels has slightly dropped as peak season starts to wrap up, but the problems remain significant. As the port waiting que decreases or is eliminated, this will be a strong signal that ocean shipping firms have been able to resume more normal operations.

It takes more than ships to move retail freight from overseas to the US, and the lack of truck drivers and general trucking capacity has also resulted in a build up of container freight inside the ports after they’ve been unloaded from the ships. The cost of moving containers from the ports to a distribution center or warehouse via drayage trucking has also dramatically increased due to the supply of trucks and drivers vs the increased demand of consumers.

For retailers, planning out what items to promote in sales and the level of discount to advertise is tougher this year than in years past, as many have cargo delayed at sea waiting to unload. This uncertainty means that retailers simply don’t know if their inventory will arrive in stores in time for the black Friday rush. The shift to e-commerce focused sales does provide some flexibility, as the inventory can be shipped from a warehouse in Southern California vs needing to be delivered to stores all over the country. Items can also be sold even before they are ready to be shipped. While this can be a risky strategy due to consumer frustration from delayed or slower shipping, it’s better than items arriving late than sitting in a warehouse.

While shipping delays and inventory shortages are costly and frustrating for retailers, the increased and continued consumer demand is a strong signal for overall economic performance. Many predicted consumer demand would remain heavily depressed for much longer than it did during the pandemic.

Supply Chain Risk Mitigation

Logistics providers, retailers, and port authorities are all investing heavily to improve supply chain and logistics performance. This includes container purchases, truck purchases, even ship purchases, utilizing older ships, improving port facilities, more warehouse automation, etc. All of this is in an effort to keep inventory on the shelves and maintain a solid profitable volume of purchases.

Brands are planning ahead and ordering replenishment orders sooner as well as carrying inventory levels higher than normal in an effort to reduce the probability that one supply chain delay or disruption will result in a lack of products on the shelves. Diversifying the supplier and logistics provider base is another strategy to reduce the overall supply chain risk that many retailers are implementing. Many times a disruption that limits the output of one supplier won’t affect others.

Several firms have also announced plans to “nearshore”, often in reference to Mexico, meaning that they plan to bring global manufacturing operations closer to the US, which makes transportation and management of the facilities that much easier.

Automotive Inventory shortages

A drive past nearly any make of auto dealership will reveal very few new vehicles on the lot. Brands ranging from Ford, BMW, etc have experienced chip shortages and general inventory delays that will reduce the number of vehicles on the lots this Black Friday and throughout the holiday shopping season.

Traditionally for automotive brands, black Friday and the holidays are prime season for special financing offers, pricing discounts, lease offers etc, to move significant inventory, but this year expect to see few automotive brands offering any significant discounts.

UPS, Fedex and USPS

Parcel shipping is “the” way that e-commerce brands ship their items to buyers. While not all small e-commerce utilize full truck load freight or even LTL, they all use parcel shipping for the bulk of their needs. Parcel carriers have increased peak season surcharges and assessorial costs nearly across the board for their customers. This in addition to handling overwhelming volume with fewer workers has made parcel shipping much more expensive and resulted in poorer service times.

This is another reason why return policies and reverse logistics should be considered seriously, as returns are only getting more and more expensive for e-commerce retailers, yet easy return policies are expected by consumers and can absolutely be the reason why a consumer chooses one company over another when making a purchase.

Holiday Shipping and Technology

Shipment tracking and supply chain visibility have become even more important with the unpredictable supply chain disruptions that have plagued supply chains over the last two years. Knowing where freight is and tracking ETA, can shine a light on problems while there is still time to rectify the situation and allows supply chain managers to be more proactive in their problem solving.

Shipment tracking can reveal issues that can be narrowed down to a single warehouse, carrier, port facility or supplier, often in the form of delays or even a covid-19 breakout forcing shutdowns which managers then see via shipments “stuck” at a single location.

The more accurately that ETA’s can be calculated, the better that capacity across carriers and receiving teams at warehouses can be utilized to keep freight moving.

Intermodal for Retailers

Mode diversification should be strongly considered to improve transportation capacity constraints both on strictly domestic lanes and the inland component of international import lanes.

Transloading freight near port facilities from international 40ft containers into domestic 53ft containers can further reduce costs, as 5 40 ft containers worth of freight can fit into 3 domestic 53ft containers or dry vans, reducing inland transport costs significantly even when taking into account the cross-docking transload costs. This also gives retailers the ability to mix and match freight between containers once they land in the US but before moving to further inland locations.

Domestic intermodal is a direct comparison to over the road long haul trucking, and is more cost-effective on lanes over 500 miles. This often results in lowering costs between 10-25% depending on volume and specific lanes.

Intermodal is another tool for retailers to move freight domestically that isn’t quite as dynamic and volatile in pricing and capacity as traditional OTR trucking, adding stability to a transportation plan.

Want a free lane and cost savings analysis? – Get in Touch!

Zmodal is a top intermodal shipping company providing door-to-door intermodal, and full truckload services nationwide throughout our digital supply chain dashboard which provides easy route searching, booking, document management, and analytics. CONTACT US if you want to lower your supply chain costs or want access to North American intermodal capacity.