Volatility and uncertainty. These two words are the theme for the greater supply chain field for the last few months and will continue to be going forward likely, if we estimate, into the 4th quarter.

According to a recent Council of Supply Chain report, logistics pre-covid in 2019 represented a greater percentage of US GDP, at 7.9%. Which effectively means that a greater percentage of any item’s purchase price is going towards the supply chain costs associated with producing and transporting the item. Determining the causation of this would be quite an analysis, but, logic would point towards recent tariffs, as well as the ever increasing demand for rapid shipping to have pushed this number higher than before. It’s unclear how the full year 2020 numbers will fall, but a drop in consumer demand will likely lower the number.

More Focus on Supply chain diversity and resiliency

Price and efficiency are great, however particularly with the shutdown of factories in China during March, US companies along with those around the world, found themselves in the tough situation of inventory shortages and simply not able to replenish stock from their suppliers. For global companies like Apple and Mazda, these concerns reached national news. Mazda being an example of a company that took immediate action to avoid a complete shutdown of certain auto factories in Japan, and “emergency” tooled up a factory in Mexico to produce certain components. Mazda then air shipped these parts to Japan, all in an effort to keep their Mazda3 and CX-30 production lines running, no expense spared in this situation.

Companies that have been in this situation put it in the “we’re never going to let that happen again, ever” category. This is prompting many brands large and small to consider diversifying their supply chain and supplier management. Essentially tabulating supplier risk into their overall supply chain plan, not wanting to have “all their eggs in one basket” from a supplier perspective. Make no mistake China will continue to dominate as the top importer for many nations, but brands are looking at other options as well such as India, Thailand, Vietnam and Mexico. This will continue to play out over the next few years, as companies have a new found appreciation for supply chain reliability as they’ve learned what worked and didn’t work during the ongoing coronavirus pandemic.

Inventory Levels

Just in time inventory planning has been the go-to method for keeping working capital levels manageable, improving overall return on invested assets and lowering warehousing costs, however coronavirus has proven that very low inventory levels, might just be too low for certain raw materials, sub components used in factories and even finished products. Accordingly, warehousing demand has already risen, with many large supply chain and logistics firms looking to expand their warehouse offerings. Even Maersk, known firstly as one of the largest ocean carriers, recently spent over 500Million US dollars to acquire a warehousing provider to keep up with customer demand for the value added service.

Expect to see continued expansion into warehousing for existing players and warehousing revenues to jump.

More tariffs?

While most economists would argue that tariffs are inefficient and ultimately pass on the costs to consumers, nearly everyday over the last week new tariffs proposals have been discussed from Washington. Now if these tariffs, on both Asian and European products, will be implemented, or if they are, what their final form will be… who knows. What we do know is that any company that imports these items will be keeping a very close eye on the situation, as a 20-25% tariff can easily turn a healthy profitable product into a money losing affair.

Capacity and Rates

Volatility is high. With some Origin/Destination pairs seeing volumes rise and have little capacity to spare which is sending rates higher than previously expected, then on many other lanes, there are still more trucks than loads available which keeps rates depressed. Ocean rates on some lanes have also climbed, particularly on transpacific lanes, as carriers have blanked sailings, which pushes rates higher than they were in April or May. Air freight also increased slightly from the horrendous 25% drop in April YoY. Amazingly in April even with these volume declines, capacity dropped by 41% sending air rates higher, and passenger carriers started converting some passenger planes to carry limited amounts of critical freight.

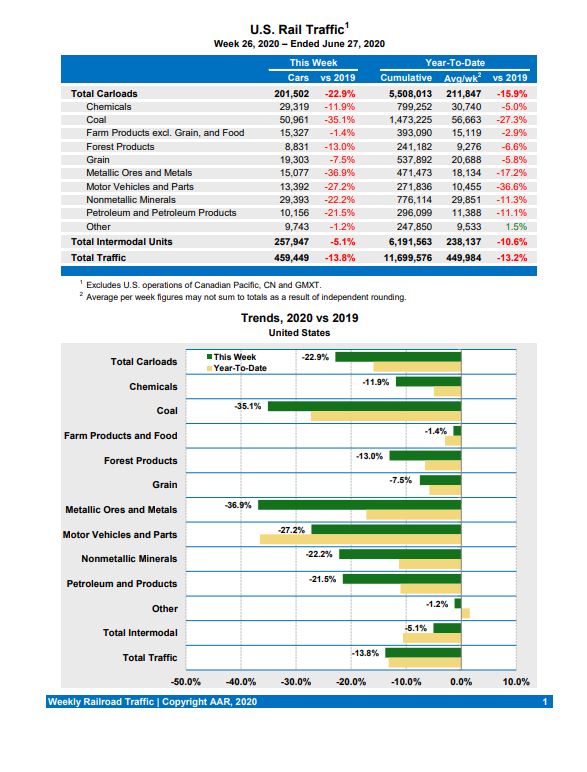

Railroads have been hit hard by the drop in auto traffic due to the large auto brands halting production. Coal, general freight and intermodal have experienced drastic drops in volume as well. Railroad pricing doesn’t fluctuate as quickly as trucking pricing does, therefore intermodal rates really haven’t changed a meaningful amount. In an AAR report released July 1, rail carriers were optimistic that volumes would slowly rise, and were glad that automotive traffic as well as intermodal were slowly starting to climb, albeit still much lower than last year.

It’s anyone’s guess as to how quickly volumes will return to normal, but likely it will be into the latter part of the 3rd or start of the 4th quarters.

Record COVID Cases

Yesterday there were over 51,000 new cases of COVID19 just in the United States, representing an all-time high for daily new cases; records have been set nearly every day over the last week. Many are predicting this number will continue to rise, as many states, particularly the south east and California, are experiencing rapid spread of the virus.

Some states are considering a second partial shutdown to curb the spread of the virus.

What does this mean for supply chains? Coronavirus is the major wildcard. One possibility is that transportation demand stops recovering as businesses partially close again, or another possibility could be that this new wave of COVID is thwarted somewhat by states and local governments imposing stricter measure regarding the reopening of businesses and pushing for the widespread use of facemasks.

It’s very possible that record numbers will continue to be reported through August, which would prevent freight volumes from continuing to increase and push a full “freight volume recovery” even further off.

Look for more supply chain and freight market updates coming from Zmodal over the coming months.

Recommended for further reading:

https://www.worldometers.info/coronavirus/

Zmodal provides comprehensive supply chain solutions that are data based and focused on optimizing your supply chain logistics plan for better reliability and efficiency. We focus on a multimodal approach to building resiliency that is backed by a first class team that provides 24/7 support and the technology to keep your supply chain connected and visible. Our technology provides shippers easy access to convert over the road freight to intermodal. If you want to talk or want a completely free initial consultation, give us a shout!

Comment